IncomeProtector - Short Term Accident Disability Coverage

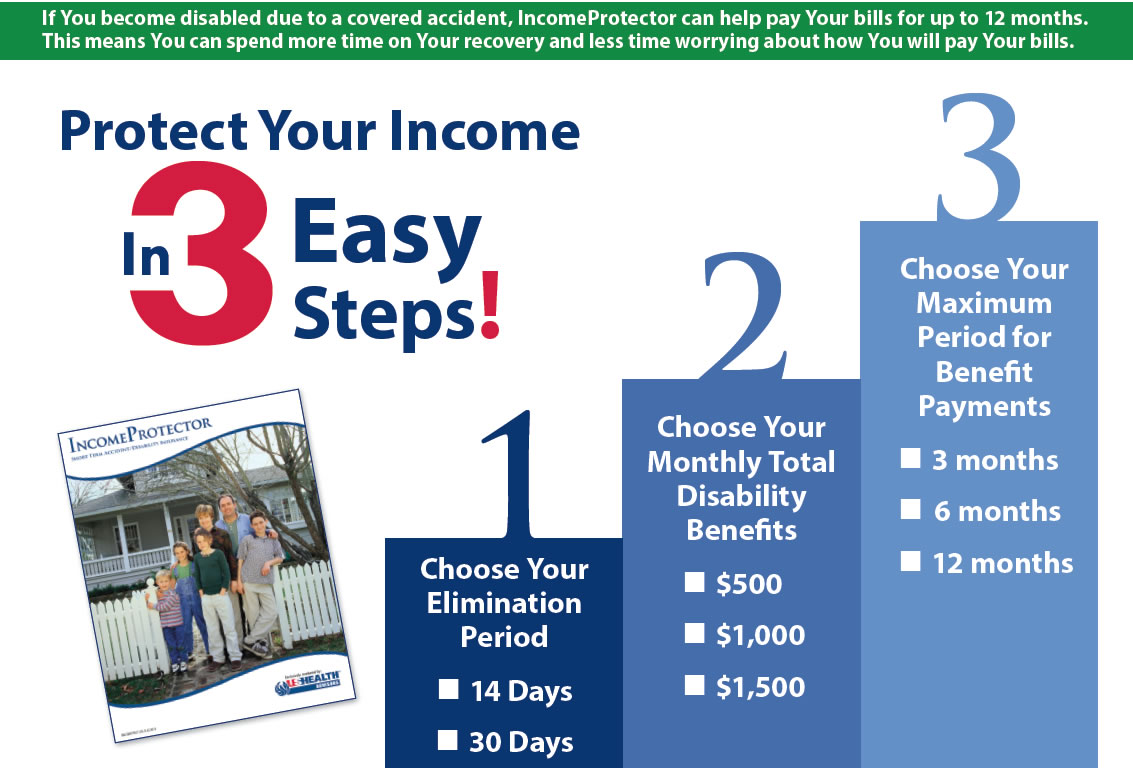

Short Term Accident Disability Insurance can help you pay your bills if you become disabled due to a covered accident. If you become totally disabled due to a covered accident, IncomeProtector can pay you monthly benefits for up to 12 months.

How Long Could You Survive Financially Without a Paycheck?

Whether you have a family or are a team of one, the bills don’t stop just because You are sidelined with an accidental injury. When accidents happen, IncomeProtector can help by providing monthly benefits to assist You with bill payments and general expenses. Don’t let the unexpected stop You in your tracks. We hope an accident never happens, but if it does, it’s better to be prepared. IncomeProtector can be an important part of Your overall game plan of protection.

- 49% of workers would have difficulty supporting themselves within one month of becoming disabled. 1

- In the U.S., a disabling injury occurs every second. 2

IncomeProtector is not available in all states. Benefit amounts and availability may vary by state. Please contact a licensed agent for more information. Limitations, Waiting Periods and Exclusions may apply.

The IncomeProtector Plan provides disability income benefits for disability resulting from covered accidental bodily injuries and is neither a traditional major medical plan nor a Workers Compensation plan under state law. The IncomeProtector Plan is considered an “excepted benefit plan” under the ACA and is not a “minimum essential coverage” plan under the ACA. The ACA generally required individuals to maintain “minimum essential coverage” or be subject to the payment of the annual shared responsibility payment with the payment of their taxes to the federal government. Congress eliminated the shared responsibility payment in 2019 and beyond for individuals who do not maintain ACA “minimum essential coverage” during 2019 or any year thereafter.

1 The Disability Survey conducted by Kelton Research on behalf of the LIFE Foundation, April 2009

2 National Safety Council®, Injury Facts® 2010 Ed.